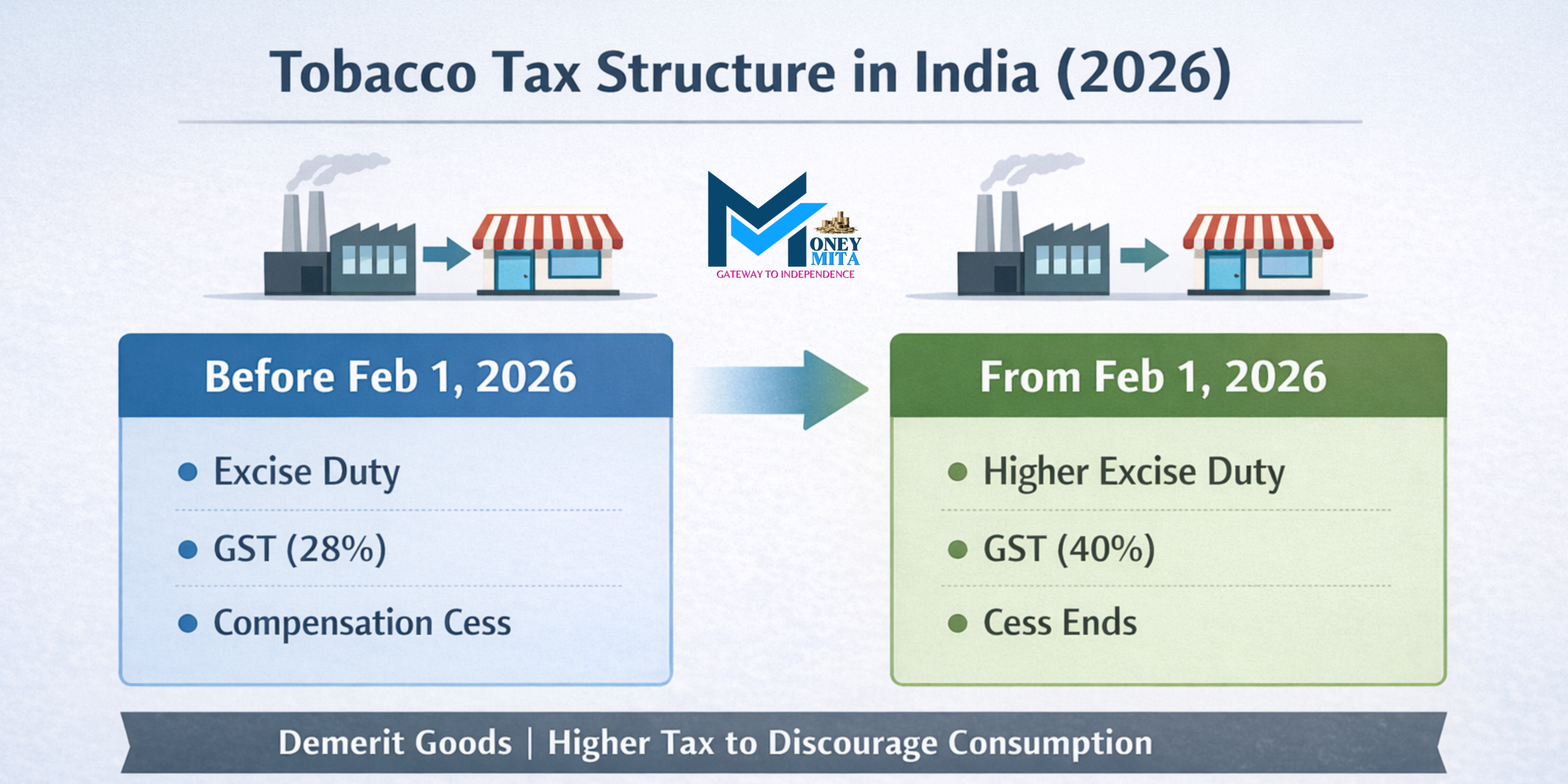

India’s tobacco taxation framework is entering a decisive phase as the “tobacco excise duty 2026 reforms” align with the scheduled end of the GST compensation cess. For manufacturers, retailers, and consumers, these changes are important as they directly affect pricing, tax structure, and market dynamics.

Tobacco products in India attract one of the highest indirect tax burdens, with Central Excise Duty, National Calamity Contingent Duty (NCCD), GST, and GST compensation cess operating together. While excise duty is levied and collected by the Central Government—with a portion of the revenue shared with States through Finance Commission devolution—GST ensures taxation across the supply chain. As 2026 approaches, the withdrawal of compensation cess marks a significant shift in India’s indirect tax framework for tobacco.

Table of Contents

ToggleExcise Duty on Tobacco and Pan Masala

PRESENT DAY TAX REGIME

Until the current tax changes take effect in 2026, tobacco and pan masala products have been subject to a multi-layered tax structure under India’s indirect tax system. Unlike most goods, these demerit products attract more than one form of taxation.

They are taxed through:

- Central excise duty at the manufacturing stage.

- National calamity contingent duty (NCCD) was introduced by the Finance Act 2001 and continuing till date.

- GST at 28% on supply.

- An additional GST compensation Cess is levied alongside the GST.

This Four-tier tax structure is specific to products such as cigarettes, tobacco, and pan masala, reflecting the government’s approach to taxing harmful goods while securing substantial revenue heavily.

What is the excise duty on tobacco?

Excise duty on tobacco is a Central tax levied on the manufacture or production of tobacco products within India. Unlike GST, which is collected at the point of supply, excise duty is imposed at the manufacturing stage, making it an indirect tax that is typically passed on to consumers through higher retail prices.

The excise duty on tobacco serves two (2) key purposes.

- First, it provides a steady source of revenue for the Central Government, with a portion shared with States through the Finance Commission devolution.

- Second, it acts as a fiscal deterrent, increasing the cost of tobacco products to discourage consumption.

Excise duty rates vary across tobacco products. Cigarettes are taxed based on their length, with longer cigarettes attracting higher duties. Bidis continue to attract comparatively lower excise duty, reflecting socio-economic considerations. Smokeless tobacco products, such as chewing tobacco and tobacco-containing pan masala, are subject to separate duty structures.

Pan masala containing tobacco attracts significantly higher excise duty than pan masala without tobacco, reflecting the government’s intent to discourage tobacco use while maintaining a differential tax treatment for non-tobacco products.

What changed in the excise duty in 2026?

- End of the Compensation Cess Era: The key change in 2026 is the phasing out of the GST compensation cess on tobacco products and the restructuring of the tax framework around excise duty and GST.

- From Four(4) Taxes to Three(3): Since 2017, tobacco products have been subject to a four-layer tax structure—central excise duty, NCCD, 28% GST, and an additional GST compensation cess. With effect from February 1, 2026, the compensation cess mechanism comes to an end, and tobacco taxation shifts to a three-layer structure comprising excise duty and NCCD at the manufacturing stage and GST at the supply stage.

- New Levies Replace the Old Cess: To offset the withdrawal of compensation cess, the government has introduced additional excise duties on tobacco products and a Health and National Security Cess on pan masala, as notified. These levies are designed to broadly maintain revenue neutrality while changing the mode of collection. In the case of pan masala, the new cess is linked to the production capacity of manufacturing units.

- Simpler Administration, Same Control: From an administrative perspective, the revised structure simplifies compliance by replacing multiple overlapping levies with a more streamlined framework.

- Impact on State Revenue Flow: While States will no longer receive compensation from the cess pool, they will continue to receive their share of GST revenues, along with a portion of excise collections through Finance Commission devolution.

- What It Means in Practice: Overall, the revised excise framework changes the form of taxation rather than the burden, aiming to simplify administration while retaining strong fiscal control over tobacco products.

Why was the GST Compensation Cess introduced?

The GST compensation cess is levied under the Goods and Services Tax (Compensation to States) Act, 2017.

THE BEGINNING

The compensation cess was introduced in 2017 alongside the rollout of GST. As part of the transition, States agreed to subsume several indirect taxes into GST, raising concerns about possible revenue losses.

To address these concerns, the Central Government assured States that any shortfall in GST revenue would be compensated for a five-year period from July 1, 2017 to June 30, 2022. This compensation period was later extended to account for revenue disruptions caused by the COVID-19 pandemic, based on recommendations of the GST Council.

Objective of the Cess

The primary objective of levying compensation cess was to create a dedicated fund to compensate States for revenue losses arising from the implementation of GST.

Who Collects Compensation Cess

Compensation cess is collected by taxpayers supplying notified goods and services, including imports. Exporters may pay compensation cess on exports, but are eligible to claim a refund. Taxpayers opting for the composition scheme are not required to collect compensation cess.

Input Tax Credit of Compensation Cess

Input tax credit of compensation cess can be utilised only for payment of compensation cess and cannot be set off against CGST, SGST, UTGST, or IGST.

GST Compensation Cess on Tobacco

The GST compensation cess on tobacco was introduced in 2017 as part of the GST transition framework discussed above. Tobacco products, along with certain luxury goods and automobiles, were classified as demerit goods, making them suitable candidates for an additional levy beyond GST.

For tobacco products, the compensation cess was significant and product-specific. Cigarettes attracted a compensation cess ranging from around 5% to as high as 290%, depending on factors such as length and filter type, levied over and above the 28% GST rate. Smokeless tobacco products, including chewing tobacco and similar items, faced cess rates broadly ranging between 60% and 96%, while pan masala containing tobacco was also subject to high compensation cess rates.

Following the introduction of GST, excise duty on tobacco products continued but was restructured, with a larger portion of the tax burden shifting towards GST and compensation cess compared to the pre-GST regime. This change altered the composition of taxation without eliminating excise duty.

The revenue collected from compensation cess was credited to a dedicated compensation fund, from which States were compensated for GST-related revenue shortfalls. Under the Compensation to States framework, States were assured 14% annual revenue growth over their 2015–16 base year, a guarantee that played a crucial role in building State consensus for the rollout of GST.

Why is the Compensation Cess ending in 2026?

The GST compensation cess was designed as a temporary measure from the outset. Under the GST (Compensation to States) Act, 2017, States were assured compensation for revenue shortfalls for five years from 1st July 2017 to 30th June 2022 as explained in “GST Compensation Cess: Meaning & Purpose”.

The COVID-19 pandemic severely disrupted tax collections, resulting in a shortfall in the compensation fund. To meet compensation commitments, the Central Government raised ₹2.69 lakh crore through back-to-back loans during 2020–21 and 2021–22. To repay these borrowings, the GST Council allowed the collection of compensation cess to continue beyond June 2022.

Although the loan repayment schedule extended up to March 2026, strong cess collections enabled the Central Government to prepay the outstanding loans by November 2025. This early repayment made it possible to discontinue the compensation cess from February 1, 2026, instead of continuing it until March 2026.

After February 1, 2026, the compensation mechanism ceases, and States will no longer receive guaranteed compensation for GST-related revenue shortfalls. State revenues will thereafter depend on their share of GST collections, devolution of Central taxes (including excise duty) as per Finance Commission recommendations, and their own taxation powers.

The discontinuation of the cess simplifies the indirect tax structure while marking a full transition to the GST framework as originally envisaged.

How Tobacco Is Taxed Under the GST Regime?

POSITION BEFORE FEBRUARY 1,2026

Pursuant to the 56th GST Council meeting held on September 3, 2025, the GST rate structure was rationalised with effect from 22 September 2025 into three slabs:

- 5% (Merit rate) for essential goods.

- 18% (Standard rate) for most goods and services.

- 40% (Demerit rate) for luxury and sin goods.

As part of this rationalisation, the 28% GST slab was removed for most goods and services. However, tobacco and related products, categorised as sin goods, were excluded from the immediate transition.

Accordingly, up to 31 January 2026, tobacco products such as cigarettes, pan masala, gutkha, chewing tobacco, zarda, unmanufactured tobacco and bidi continued to attract :

a) GST at 28% and b) GST compensation cess, as applicable.

POSITION FROM FEBRUARY 1,2026

With effect from 1 February 2026, GST rates on tobacco and pan masala were formally realigned with the demerit rate structure. The applicable GST rates are notified through a combined reading of:

- Notification No. 09/2025-Central Tax (Rate) dated September 17,2025.

- Notification No. 19/2025-Central Tax dated December 31,2025, which amended the GST rate schedules to operationalise the 40% demerit rate.

| HSN CODE | DESCRIPTION | GST RATE 👉From 01.02.2026 |

| 2106 90 20 | Pan masala | 40% |

| 2401 | Unmanufactured tobacco (other than tobacco leaves) | 40% |

| 2402 | Cigars, cheroots, cigarillos and cigarettes | 40% |

| 2403 (Excluding BIDI) | Manufactured tobacco products other than bidi | 40% |

| 2404 | Tobacco/nicotine products for inhalation without combustion | 40% |

| 2403 (bidi) | BIDI | 18% (Ad Valorem) |

Important clarification: Although bidi falls under HSN 2403, it is specifically carved out and taxed at 18%, while all other products under HSN 2403 attract 40% GST. This differential treatment is explicitly reflected in the amended schedules.

Why Tobacco Has Both Excise Duty and GST?

- The Indian Constitution permits both excise duty and GST to apply to tobacco.

- Excise duty is a Central tax levied at the manufacturing stage, when tobacco products are produced and cleared from the factory.

- GST is levied later on the supply of goods, as the product moves through the distribution chain.

- This dual system is intentional policy design, not an overlap or mistake.

- Excise duty is charged first, and GST is then calculated on the value including excise duty, which increases the overall tax burden.

- The structure ensures strong revenue collection while discouraging consumption of harmful products like tobacco.

Tobacco is taxed twice—through excise at manufacture and GST at sale—to deliberately raise prices and discourage consumption of a harmful product, unlike alcohol, which is fully kept outside GST.

Impact of Tobacco Tax Changes After February 1, 2026

Overall Impact

The replacement of GST compensation cess with higher excise duty and new cesses is designed to keep tobacco products expensive, thereby continuing the government’s public health objective of discouraging consumption. While the form of taxation changes, the overall tax burden is unlikely to reduce significantly.

The shift from a Four-tier structure to a three-tier system (excise+NCCD+GST) also simplifies tax administration for manufacturers and authorities, even as enforcement challenges remain.

Impact on Prices

The end of the compensation cess does not automatically mean lower tobacco prices. If the cess had lapsed without replacement, prices—especially of cigarettes and tobacco-based pan masala—could have fallen sharply, undermining public health goals.

However, most analysts expect the government to raise excise duties to broadly offset the outgoing cess, keeping prices relatively stable. As a result:

- Consumers are likely to see minimal price changes.

- Relative prices across product categories may shift.

- Excessively high taxes may still pose risks of illicit trade, requiring stronger enforcement.

With the cessation of the compensation cess, States will no longer receive guaranteed compensation payments. Instead, they will depend on:

Impact on State Government Revenue

With the cessation of the compensation cess, States will no longer receive guaranteed compensation payments. Instead, they will depend on:

- Their share of GST collections and,

- Devolution of Central excise duty revenue as per the Finance Commission recommendations.

While this increases revenue uncertainty for States—especially those with fiscal stress—it also creates stronger incentives to improve tax compliance and enforcement. Over time, a simpler and more transparent tax structure may help offset some revenue volatility by reducing evasion and administrative inefficiencies.

Frequently Asked Questions(FAQ)

Q1. Which State taxes were subsumed with the introduction of GST?

Ans. With the introduction of GST, the following major State taxes were subsumed:

- Value Added Tax (VAT) / Sales Tax.

- Octroi and Entry Tax.

- Purchase Tax.

- Luxury Tax.

- Entertainment Tax (levied by States).

👉 These taxes were replaced by State GST (SGST) under the unified GST framework.

Q2. What does HSN stand for?

Ans. HSN stands Harmonised System Of Nomenclature.

It is an internationally accepted system used to classify goods in a uniform manner for taxation, customs, and trade purposes. Under GST, HSN codes help determine applicable tax rates and ensure consistency in classification.

Q3. How many digits are there in an HSN code?

Ans. An HSN code can have 2, 4, 6, or 8 digits, depending on the level of detail required. Under GST, the 6-digit HSN is commonly used, while the 8-digit HSN provides more detailed classification for precise rate application.

Q4. What do HSN Digits indicate?

Ans. Each part of an HSN code provides progressively detailed information about a product.

Structure of an HSN code: Chapter ➡️ Heading ➡️ Sub-heading ➡️ Tariff Item.

Let us understand this with a real example: a tobacco product falls under a demerit tax category, attracting a central tax rate of 20% (resulting in a combined GST rate of 40%).

HSN Codes used in the example:

2401, 2402 20, 2402 20 90.

- First 2 digits (24) indicate the Chapter.

- First 4 digits (2401 / 2402) indicate the Heading.

- First 6 digits (2402 20) indicate the Sub-heading.

- First 8 digits (2402 20 90) indicate the Tariff Item.

Explanation: Chapter 24 of the HSN covers tobacco and manufactured tobacco substitutes. Within this chapter, HSN 2401 relates to unmanufactured tobacco, while HSN 2402 covers manufactured tobacco products such as cigarettes. Further, HSN 2402 20 specifically refers to cigarettes containing tobacco, and HSN 2402 20 90 covers other cigarettes.

Q5. What types of “Sin Goods” attract additional tax burden under the GST regime?

Ans. Sin goods under the GST regime are products considered harmful or non-essential and therefore taxed at higher rates or subject to additional levies as GST Compensation Cess. These include:

👉Cigarettes and other tobacco products, Pan masala and gutkha, Aerated (carbonated) drinks, Luxury goods, Certain automobiles.

➡️These goods are called demerit goods because their consumption is considered harmful to health or society, or because they are luxury items primarily consumed by higher-income groups, which justifies higher taxation to discourage their use.

I am a practicing Chartered Accountant, now venturing into content writing. Covering money matters—taxation, finance & financial news—presenting accurate, easy-to-understand insights, combining professional knowledge with a passion for educating readers on managing and understanding their finances better.