Table of Contents

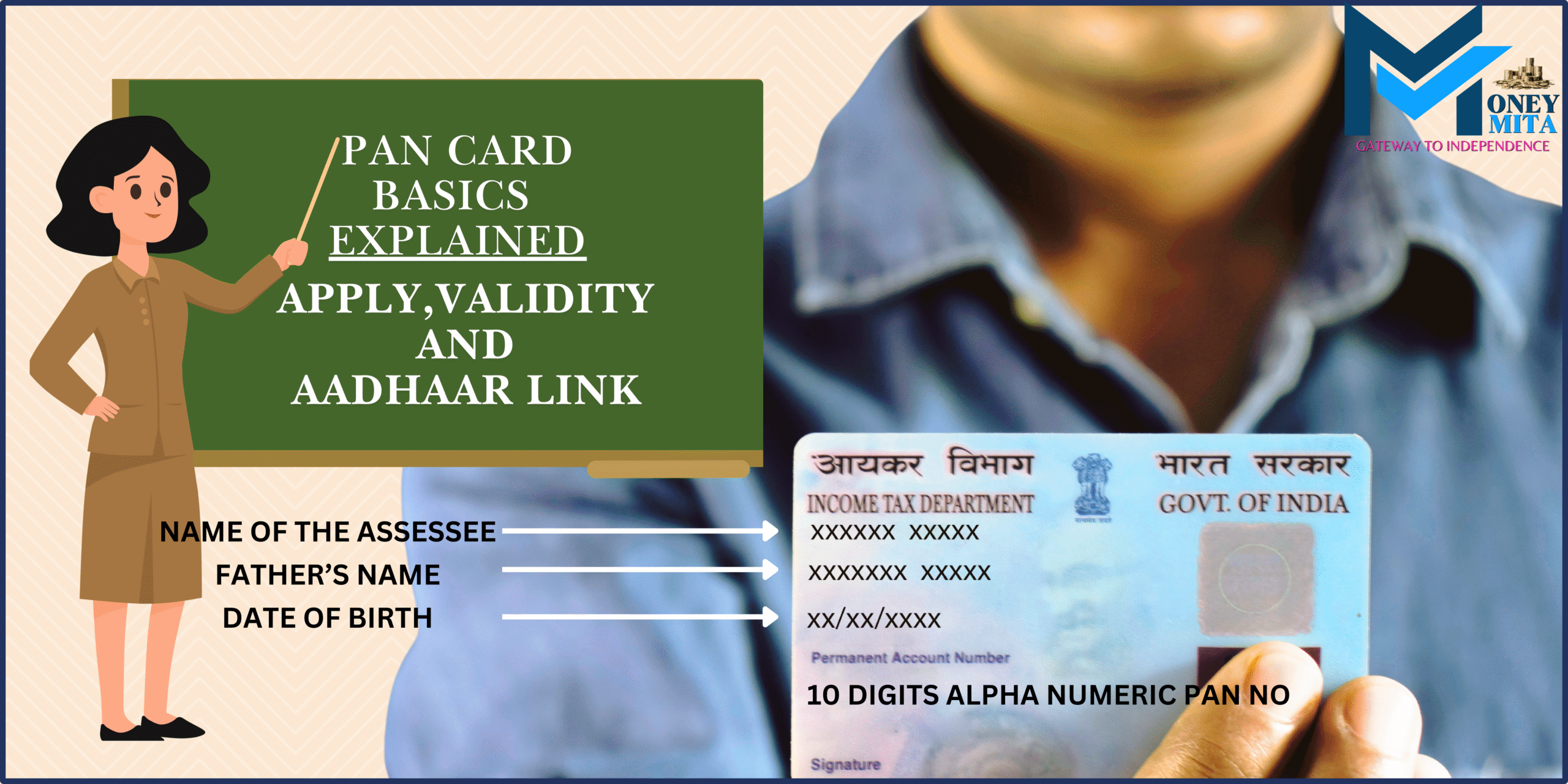

TogglePAN Card Guide – Basics, How To Apply, Validity & AADHAAR Link

“PAN CARD BASICS EXPLAINED” starts with explaining that a PAN, or Permanent Account Number, is a 10-character alphanumeric identifier provided by India’s tax authorities. It is an identification number for all communications with the Income Tax Department in India. It helps to link and monitor various financial activities to ensure transparency in the taxation system. Whether you’re applying for the first time, updating details, or linking PAN with Aadhaar, this guide walks you through all the essentials—from PAN card basics, application steps and linking with AADHAAR to its validity and required forms.

PAN Card Basics Explained:-What Is A PAN Card?

WHAT IS PAN?

A unique 10-digits alpha-numeric number is issued to any “PERSON” who applies for it or to whom the department allots it. The IT Department records all tax-related transactions and pieces of information of a “PERSON” against its unique PAN. Each PAN acts as a database of each assessee.

Physical Card: The PAN is printed on a laminated physical card for official use and identification. The card features the assessee’s name, photograph, date of birth, and father’s name.

Structure Of PAN – Understanding PAN Card Format

PAN Card Basics Explained: Each PAN is a 10-character mix of letters and numbers, designed in a fixed pattern to identify taxpayers uniquely.

- The first three (3) characters are a sequence of letters from AAA to ZZZ.

- The next fourth (4th) character indicates the type or category of the PAN holder.

Ten (10) types of status are given below for easy reference. Here’s a catchy mnemonic using the first letters of each category

A Big Cat Found Green Hats – Jumped, Laughed, Played and Twirled.

- A – AOP / Association of persons

- B – BOI / Body of individuals

- C – Company

- F – Firm

- G – Government Agency

- H – Hindu Undivided Family

- J – Artificial Juridical Person

- L – Local Authority

- P – Individual

- T – Trust

The fifth (5th) character corresponds to the first letter of the individual’s last name or the entity’s official name.

The next four characters (6th to 9th) consist of a numeric sequence ranging from 0001 to 9999.

The tenth (10th) character: Alphabetic check digit.

Example: Mr Deepak Dam has obtained PAN BHCPD3741H from the department.

Let’s break characters as per the above notation.

- BHC : Alphabetic series.

- P : Denotes an individual.

- D : First letter of the surname (e.g., Dam).

- 3741: Sequential number.

- H : Check digit.

Who Should Apply For A PAN Card?

PAN Card Basics Explained:- This section outlines who is eligible for a PAN card, the types of applicable transactions, and the timeline for application.

1. Income Tax Assessees

- Persons Having Taxable Income:-Every person whose total income or total income of any other person in respect of which he/she is assessable during the financial year exceeds the maximum amount not chargeable to tax is required to make an application for PAN before 31st May of the assessment year.

- Non-Individual Residents Engaging in High-Value Transactions:- Every resident, other than an individual, who enters into a financial transaction aggregating to ₹2.50 lakhs or more in a financial year is required to make application for PAN before 31st May of the assessment year.

- Key Persons Associated with Non-Individual Entities:-Individuals such as Managing Directors, Directors, Partners, Trustees, Authors, Founders, Karta, Chief Executive Officers, Principal Officers, or any person competent to act on behalf of the entities referred in preceding clause above, must make an application for allotment of PAN within the same time limit mentioned above.

- Business / Profession:- In case of total sales, turnover, or gross receipts of the business/ profession of an assessee exceeds or is likely to exceed INR five lakhs (₹5 Lakhs) during a financial year, you need to make an application for a PAN allotment before the completion of the financial year.

- Trusts: Charitable trusts that are required to submit their income tax returns under Section 139(4A) of the Income Tax Act, 1961, must ensure they apply for a PAN before the financial year concludes.

- Recipients subject to Tax Deduction At Source(TDS):-Every person who is entitled to receive any sum or income after deduction of tax at source must get PAN before the conclusion of the financial year.

2. Other Tax Assessees

- Importers & Exporters:-Individuals or entities involved in import or export activities, requiring an Import Export Code (IEC), must have a PAN as it is a prerequisite for obtaining the IEC.

- GST Registrants:-Since the Goods and Services Tax (GST) registration number is PAN-based, obtaining a PAN is mandatory for GST registration.

- Individuals registered under the Central Excise Act or as Service Tax assessees are required to possess a PAN.

- Persons issuing Cenvatable Invoices under Rule 57AE and registered under the Central Excise Rules 1944.

- Persons registered under the Central Sales Act or the general tax law of the appropriate State or Union Territory.

For a detailed explanation of excise duty on tobacco, see “Tobacco Excise Duty 2026: GST Cess Ends.”

3. Specified Transactions

Persons intending to enter into financial transactions where quoting of PAN is mandatory, which are specified under Rule 114B of the Income Tax Rules.

Ex:- Such as the sale or purchase of a motor vehicle, opening a bank account in any banking institution or post office etc.

4. Prescribed Transactions

Any person intending to enter into any specified transaction shall apply for allotment of PAN at least 7 days before he intends to enter such transaction.

Ex:- opening a current or cash credit account with a bank or post office.

5. Foreign Entities with Taxable Transactions in India

Foreign companies or entities earning income in India, such as through investments, royalties, fees for technical services, or dividends, are required to obtain a PAN if:

a)They maintain a business connection or a fixed place of establishment in India.

b)They wish to claim benefits under the Double Taxation Avoidance Agreement (DTAA).

c)They engage in transactions where quoting of PAN is mandatory.

6. Voluntary Applicants

Individuals not covered under the mandatory categories may still apply for a PAN voluntarily. Having a PAN facilitates various financial transactions and serves as a valid proof of identity.

PAN Application Forms & Required Documents

| FORM NUMBER | APPLICABLE TO | PURPOSE |

| 1. 49A | Indian citizens (including NRIs) and entities incorporated in India. | Application for allotment of PAN under Section 139A of the Income-tax Act, 1961. |

| 2. 49AA | Individuals who are not citizens of India and entities incorporated or formed outside India. | Application for allotment of PAN as per Rule 114 of the Income-tax Rules, 1962. |

| 3. SPICe – INC – 32 | Companies incorporated in India. | Integrated application for company incorporation, including allotment of PAN and TAN. Filed via the Ministry of Corporate Affairs (MCA) portal. |

| 4. FiLLiP – For Limited Liability Partnerships (LLPs) | Newly incorporated LLPs in India. | Used for incorporating a Limited Liability Partnership (LLP), along with the simultaneous allotment of PAN and TAN. Filed via the Ministry of Corporate Affairs (MCA) portal |

| 5. Combined Application Form (CAF) meant for Foreign Portfolio Investors (FPIs) | FPIs intending to invest in Indian markets. | Single application for FPI registration with SEBI, allotment of PAN, KYC, and opening of bank and demat accounts. Accessible via the NSDL FPI portal. |

PAN AADHAAR Linking

Effective Date: From July 1, 2017.

Requirement: Any individual eligible for an Aadhaar number must mention either their Aadhaar number or Aadhaar Enrolment ID in the PAN application form.

Legal Basis: As per Section 139AA of the Income-tax Act, 1961.

Click here:- Finance Act And Income Tax Act.

Linking of PAN & AADHAAR:– It is a mandatory requirement by the Government of India, failing which PAN becomes inoperative. It is one of the important PAN Card Basics explained.

Guidelines For Submission Of PAN Forms

Supporting Documents:- As per Rule 114 of the Income Tax Rules,self-attested copies of the following must be submitted with the application for PAN.

a)Proof of Identity (POI),

b)Proof of Address (POA), and

c)Proof of Date of Birth (PODB) or the date of incorporation, as applicable.

Fees: All applicable processing fees must be paid as specified by the Income Tax Department.

PAN Card Preference: Applicants should indicate whether they need a physical PAN card or an E-PAN. If you choose an E-PAN, a valid email address is required, as the E-PAN will be sent in PDF format to the registered email address.

PAN Card Basics Explained:- How To Apply For A PAN

Anyone can apply for a Permanent Account Number (PAN) by visiting the nearest Tax Information Network (TIN) Facilitation Centre/PAN Centre or through online application via the designated portals.

Protean Portal:- Formerly known as NSDL E-Governance Infrastructure Limited, it has been rebranded as Protean EGov Technologies Limited. This company is one of the key IT-enabled solution providers in India. [https://www.protean-tinpan.com/]

UTIITSL Portal:- UTI Infrastructure Technology and Services Limited is a government owned entity incorporated under section 2(45) of the Companies Act. Established in 1993, it provides information technology services and acts as a PAN card issuer and printer on behalf of the Income Tax Department of India (CBDT).

You can track the status of your PAN application here: [https://www.pan.utiitsl.com/PAN/]

Validity And Lifespan Of A PAN Card

Lifetime Validity:- Once issued, a PAN remains valid for the lifetime of the holder, regardless of changes in address or other personal details.

Updating PAN Details: If there are changes in personal information, such as your name or address, these changes must be communicated to the Income Tax Department by submitting the Form for Requesting a New PAN Card or for Making Changes/Corrections in PAN Details.

Holding Multiple PANs

Prohibition: Legally, an individual is allowed to hold only one PAN. Holding multiple PANs is against the law.

Penalty :-According to Section 272B of the Income Tax Act, 1961, holding multiple PANs can lead to a penalty of ₹10,000/- for each additional PAN.

Surrender of Extra PANs: If you possess more than one PAN, it is essential to surrender the additional PAN(s) promptly to prevent penalties.

Frequently Asked Questions (FAQ)

Q1. Is it compulsory to file an Income Tax Return (ITR) after obtaining a PAN?

Ans. No, filing ITR is only mandatory if you are liable under Section 139 of the Income Tax Act, 1961. But it is also true that being liable, one can’t file ITR without mentioning PAN, except in PAN-AADHAAR linking case.

Q2. Can a person submit an ITR without mentioning PAN?

Ans. Yes, since 01.09.2019, if PAN and Aadhaar are linked, Aadhaar can be used in place of PAN for filing ITR as per Section 139AA of the Income Tax Act 1961.

Q3. Should PAN be shared with the deductor?

Ans. YES. Effective from 01.04.2010, failure to provide PAN to the deductor may result in TDS being deducted at a rate of 20% or more.

Q4. What is SPICe (INC-32)?

Ans. SPICe (Simplified Proforma for Incorporating a Company Electronically) is an e-form by the Ministry of Corporate Affairs (MCA) that enables company incorporation and mandatory allotment of PAN and TAN with the Certificate of Incorporation.

Q5. What is Form FiLLiP?

Ans. FiLLiP is an integrated form introduced by the Ministry of Corporate Affairs (MCA) under the LLP Act, 2008, for incorporating Limited Liability Partnerships. It includes:

- Name reservation

- Incorporation of LLP

- Allotment of DPIN [Designated Partner Identification Number]

- Application for PAN/TAN

- Conversion of firms/private companies to LLP

Q6. What is CAF?

Ans. The Common Application Form (CAF) is a unified form introduced by the Government of India on January 27, 2020, to streamline the registration process for Foreign Portfolio Investors (FPI). It consolidates multiple applications into a single form, covering:

- SEBI Registration

- Permanent Account Number (PAN) Allotment

- Know Your Customer (KYC) Compliance

- Opening Bank and Demat Accounts in India

The Common Application Form (CAF) is placed electronically on the NSDL FPI Monitor Portal: https://www.fpi.nsdl.co.in.

Concluding Note

Understanding PAN card basics helps to ensure timely application, compliance, and smooth handling of financial transactions.