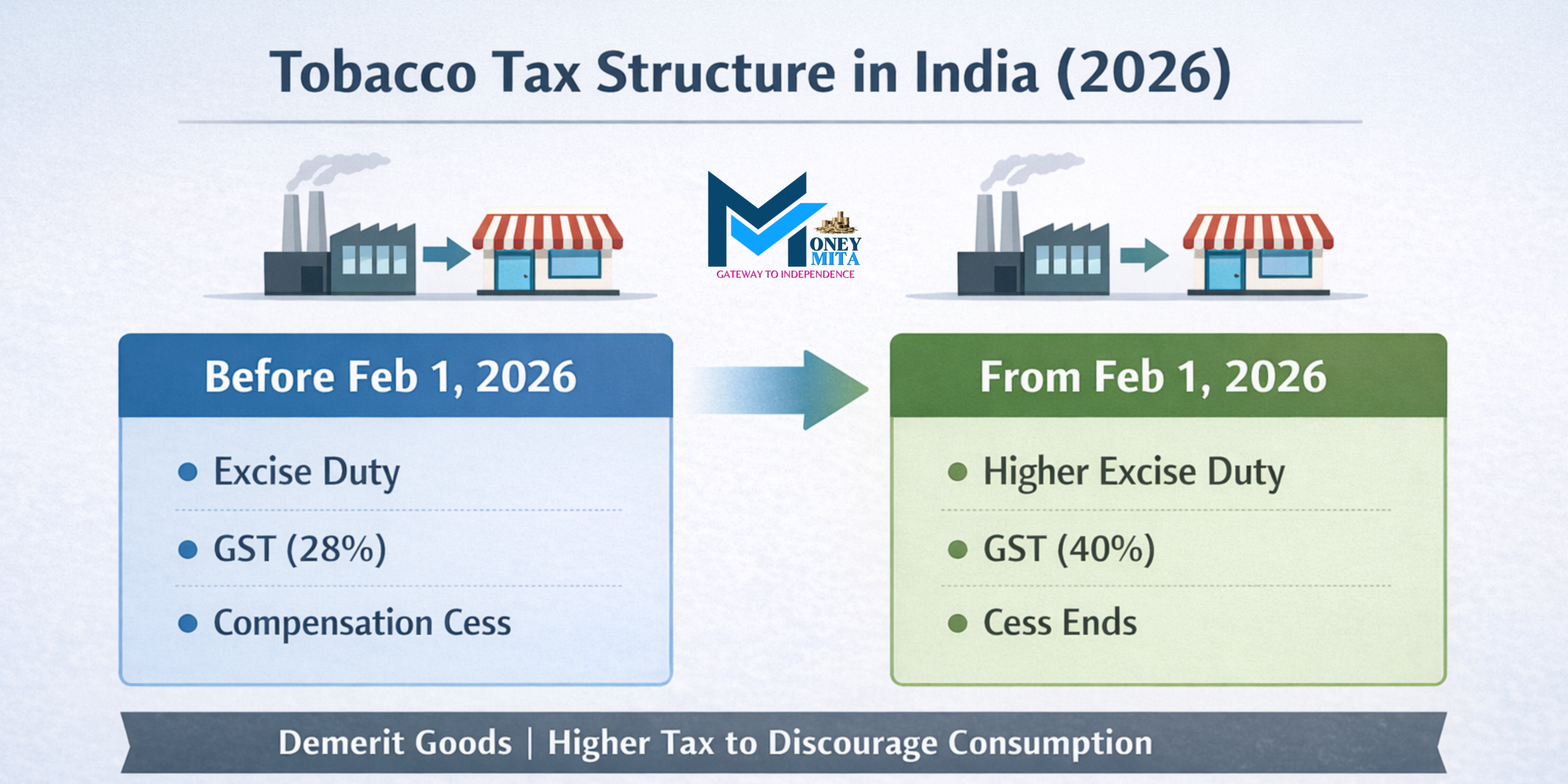

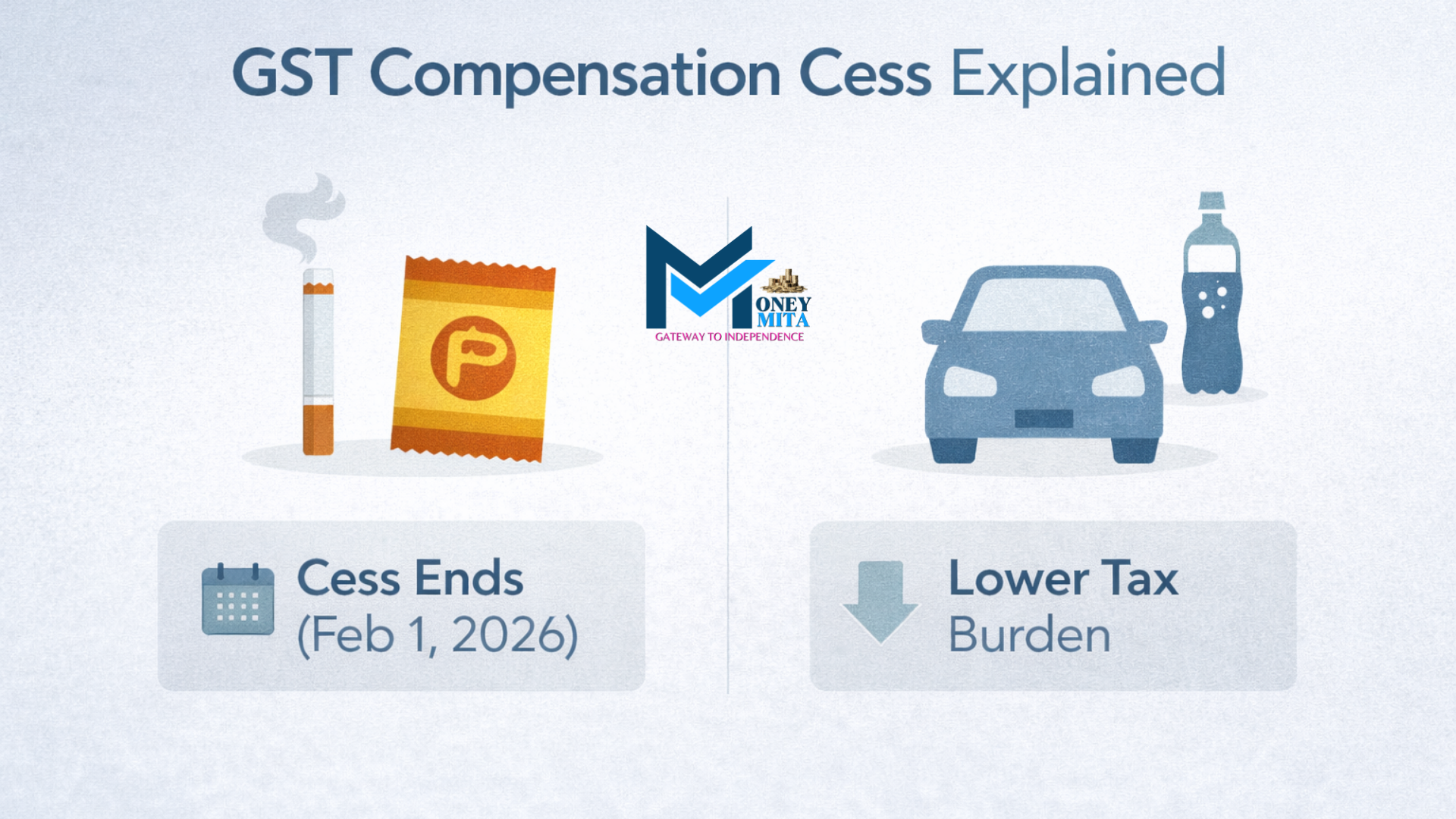

GST COMPENSATION CESS MEANING AND PURPOSE

When the GST was introduced in India in 2017, many states were concerned about a potential decline in tax revenue. To address this concern, the government introduced GST Compensation Cess, a temporary levy on select goods.The GST compensation Cess meaning is simple—it was designed to protect states from revenue loss during the shift to the GST system. The purpose of the GST Compensation Cess was to guarantee states a fixed revenue growth while the new tax structure stabilised. This article